|

You’d be forgiven if you thought I was writing about life at the grand old age of fifty, many of the readers of this article will no doubt be near or around that key milestone, half a century. Generation X, and at the prime of their careers whilst potentially preparing to hand over the baton to the next generation of leaders. That thought causes us to reflect on what state of business we are handing over, what shape is it in? How healthy is the company? Across all capitals, including financial, natural and human capitals.

This article is about a much more serious 50, hitting 50 degrees Celsius. Whilst globally many regions and cities regularly hit high temperatures of up to 50 degrees, or even higher yet. But there are many more cities that are seeing a rapid increase in temperatures, for example Kuwait saw record temperatures of 53 degrees in July 2021, making it the hottest place on earth. COP27 gives us a great opportunity to move into action. We need action, not more statements and press releases. The Middle East is warming at twice the rate of the global average. At this rate, by 2050 temperatures will increase by 4 degrees. Human influence has warmed the climate at a rate that is unprecedented in at least the last 2000 years. Thus the world faces inter-connected crises of biodiversity loss, climate change impacts, and human development inequities. Humanity is facing the next great extinction event. With polluted oceans and greenhouse gas emissions increasing, inevitably, the climate is changing. The earth’s ecosystems are reaching a tipping point beyond which means that business continuing along the same patterns will no longer be viable. The United Nations Framework Convention on Climate Change's indicators show that governments around the world are not close to the level of ambition needed to limit climate change to 1.5°C and meet the goals of the Paris Agreement 2015. A lot hinges on the agreements and commitments that will come out of the United Nations Climate Conference in Glasgow. There is hope that deep cuts in emissions of greenhouse gases could stabilise rising temperatures. Echoing the scientists' findings, UN Secretary General António Guterres said: "If we combine forces now, we can avert climate catastrophe. But there is no time for delay and no room for excuses. I count on government leaders and all stakeholders to ensure COP26 is a success.” We can witness a recovery within this generation, as put by Sir David Attenborough at the opening of COP26 climate conference in Glasgow on 1 November 2021. How might we make this transition towards the path of recovery? This is the chance for the private sector to step up, deal with the climate crisis, and it can only be done with the private sector leadership and commitment. Consumers are demanding products that don’t cost the earth. Governments and investors are calling for business to move from destroying the variety of life on earth, known as biodiversity, to contributing to its restoration. To deliver a sustainable economy, companies (primarily the led by the private sector) will need to:Understand their impact and dependence on the natural worldFocus on Net Zero and carbon capture mechanisms• Set science-based targets to drive down impact and safeguard supply chains• Act to conserve and restore biodiversity in collaboration within their own sector as well as across sectors Companies that do not rapidly change will become the brands of the past, as extinct as the wildlife they impact upon. Our activity is changing the climate in unprecedented and sometimes irreversible ways, but scientists say a catastrophe can be avoided if the world acts fast.Governments and investors alike are calling for companies to move from destroying the variety of life on earth – biodiversity – to contributing to its restoration, regeneration and stewardship. The public is now better informed about the degradation of natural capital, resulting in investors increasing demand for sustainable investment options. Those investors are now seeking assets with transparent and robust Environmental, Social and Governance (ESG) credentials. Moreover, they require strong returns out of investment funds and trusts. Now is the time. The global coalition committed to net-zero emissions by 2050 is growing, across Governments, businesses, investors, cities, regions and civil society. COVID-19 recovery plans offer the opportunity to build back greener and cleaner. Decision‐makers must walk the talk. Long-term commitments must be matched by immediate actions to launch the decade of transformation that people and our planet so desperately need. What is the role of the board? At the end of the day it is board directors, individually and collectively, who must discharge their duty to protect the interests of their stakeholders and shareholders. The concept of stakeholder capitalism, whereby business leaders are required to define their mission as creating long-term value not only for shareholders but also for customers, suppliers, employees, communities, and others, is becoming much more popular and provides a better lens through which business leaders and boards can govern their business prudently with a keen eye on the long-term horizon - for future generations and not just our current Gen X, Y and so on. This is where investors and finance comes in to play a key role. Environmental, Social and Governance (ESG) One of the key roles of the board in any organisations is about setting the purpose, vision, mission, values and strategy of the organisation that the board is overseeing. The ESG approach to investing doesn’t just focus on financial returns, it also uses ESG factors to evaluate how sustainable companies, and arguably future-proof, they are. ESG -led companies, and investment funds and trusts even more so, inherently promote the setting of ambitious, long-term sustainable objectives, which will enable them to get a better position in an increasingly competitive market. Good ESG practices are a result of good governance and oversight and it is here that good governance plays a key role since the board that drives and incorporates ESG matters into investment processes and internal decision making for companies, and therefore transforming the entire work dynamic, decision making and strategies of a company. Organisations’ awareness increases and the behaviour and culture shifts as they begin to put in place plans and actions to address and mitigate their social and environmental impacts with a long-term view. That is the only way to manage and minimise future business risks and improve their corporate image for both investors and the community. Often, the process of implementation of ESG dimensions creates opportunities for innovations, both within an organisation and also from an investment perspective allowing organisations not only to differentiate themselves from competitors with an innovative and strategic approach but to also drive improved efficient, savings and products. This is highlighted in Porter (1991) where the research clarifies that the cost of implementing and reporting on an organisation’s ESG performance may be an investment by the organisation that will be recovered and rewarded as it potentially improves efficiency and productivity. Signalling the heightened importance of ESG investments, FTSE Russell, a leading global provider of stock indexes, recently moved to tighten up the rules around reporting on ESG as well as the level of performance that listed companies are reporting. FTSE Russell has notified hundreds of companies of their removal from the approved lists over ESG performance and disclosures. Increasingly, corporations and their boards are actively being challenged on their ESG performance as indexes—and ultimately users and investors—are toughening up their approach to climate performance and the impact of carbon emissions. FTSE Russell claimed that 208 companies risk ejection from the FTSE4Good indexes because of low scores against new ESG standards. The companies on a warning represent 10% of index members. One hundred and five are from high-emitting industries, which have traditionally been good earners and stable income providers for more risk-averse investors. In addition, FTSE Russell is acting in response to requests from investors demanding more transparency in the form of improved reports detailing how those companies will increase their efforts to tackle global warming and climate-related risks. Drivers for ESG investing Apart from the obvious benefits of creating a more ethical portfolio, there is evidence that ESG investments deliver similar returns as traditional investments, potentially carrying less risk. Bloomberg has estimated the total assets under management tagged ESG could reach $53 trillion by 2025, amounting to more than a third of the projected global assets of $140 trillion. By the end of 2021, ESG assets could amount to $37.8 trillion. In addition, businesses are starting to recognise that while sustainability trends, including climate change and resource scarcity, pose significant commercial risks, they create many opportunities. Incorporating these factors into both organisational risk management and business planning is imperative. Therefore, companies need to make environmental considerations accountable. Sustainability and profitability are intrinsically linked. ESG investing and high returns A 2019 white paper produced by the Morgan Stanley Institute for Sustainable Investing compared the performance of sustainable funds with traditional funds and found that from 2004 to 2018, the total returns of sustainable, mutual and exchange-traded funds were similar to those of conventional funds. Meanwhile, other studies have found that ESG investments can even outperform conventional less sustainable ones. ‘JUST Capital’ ranks companies based on factors such as whether they pay fair wages or take steps to protect the environment. It created the JUST U.S. Large Cap Diversified Index (JULCD), which includes the top 50% of corporations in the Russell 1000 (a large-cap stock index) based on those rankings. Since its inception, the index has returned 15.94% on an annualised basis compared with the Russell 1000’s 14.76% return. ESG investing and lower risk The 2019 white paper from Morgan Stanley also highlighted that sustainable funds showed a lower downside risk than traditional funds, irrespective of the asset class. The study found that traditional funds had a significantly larger downside deviation during turbulent markets, such as the fluctuations in 2008, 2009, 2015 and 2018, than sustainable funds. This means that in comparison, traditional investments had a higher potential for loss. It is interesting to learn that ESG funds have posted strong performance during 2020. Of 26 sustainable index funds analysed by investment research company Morningstar, 24 funds outperformed comparable traditional funds in the first quarter of 2020 (during the beginning of the COVID-19 pandemic). Role of leadership - the board, governance and ESG As investors are becoming increasingly aware that a company’s performance on material ESG elements is linked directly to its long-term profitability, ESG investing is rapidly becoming mainstream, a fact that is transforming “sustainable investing” to “investing.” Most CEOs are now aware that ESG issues should be part of their corporate strategy and act cohesively in their decision-making. However, a survey conducted by PwC in 2019 of more than 700 public company directors found that 56% thought boards were spending too much time on sustainability. Findings suggest that this may be due to corporate boards lack of diversity, with most directors surveyed as male, white, and from similar backgrounds. In addition, until the last few years, boards predominantly did not have a mandate or oversight of the company’s sustainability, strategy or performance, focusing primarily on compliance tasks. This is rapidly changing worldwide and has given rise to the concept of corporate purpose, which is becoming more widely adopted and means that boards need to increase their focus on ESG concerns and manage their company for long-term success. Here is to the next 50 years and beyond and to humanity’s intelligence and ability to overcome. Author: Sandra Anani

5 Comments

How Can We Accelerate the Transition to a Circular Economy? How can we harness the power of business to resolve our economic, environmental, and social challenges? There are opportunities to profoundly change our economy, serve our community and safeguard our environment. The circular economy model is regenerative by design and requires us to rethink what we buy and how we use, reuse, reuse, repurpose and then finally if absolutely necessary recycle any item.

What Can We Do Now? While some of these circular economy concepts are being applied across the world, there remain many legislative gaps and technological barriers to global implementation. In the short to medium term, the linear economy will remain prevalent. In the meantime, the following actions have been identified as important steps towards the transition to a circular economy:

Sustainability to Action are proud to lead the Natural Capital Coalition Regional Platform in UAE4/17/2019 Press Release London & Abu Dhabi, 17th April 2019 Abu Dhabi, 17 April, 2019: We are proud to announce that Sustainability to Action will lead the Natural Capital Coalition Regional Platform in the UAE. The launch of the UAE Regional Platform is taking place today, 17 April 2019, during the Fifth Annual Abu Dhabi Sustainable Business Leadership Forum 2019, which is held by the Abu Dhabi Sustainability Group in the capital city Abu Dhabi in the United Arab Emirates. Speaking at the event, Sandra Anani, Director Sustainability to Action said: “Natural capital is about the assets that nature provides us for free. Valuing natural capital means we can understand the role of the environment as the key input into our economy. We are proud to work with the Natural Capital Coalition in the UAE to help organisations measure and value their impacts and dependencies on natural capital. The Natural Capital Protocol provides a framework for businesses to identify, measure and value their direct and indirect impacts and dependencies on natural capital and we look forward to sharing knowledge and practical know-how through the Natural Capital Coalition Regional Platform in UAE”. The UAE joins a global network including USA, Australia, South Africa, Brazil, Spain and Colombia. Natural Capital Coalition The Natural Capital Coalition is an international collaboration that unites the global natural capital community. The Coalition is made up of almost 300 organisations (and engages many thousands more) who together represent all parts of society and span the global economy. Coalition organisations have united under a common vision of a world that conserves and enhances natural capital. The Coalition is working to develop and encourage an international ‘enabling environment’ for natural capital approaches. This environment will cultivate the climate necessary to support the transition to a society in which the natural capital approach is an integral part of public and private decision-making. Regional Platforms A Regional Platform is a collaboration of interested parties coming together at a national, sub-national, regional or local level to advance natural capital thinking. Regional Platforms connect leaders and leading initiatives to ensure that the right people are communicating across the system, and will provide a space for geographic and context- specific challenges and opportunities to be discussed among stakeholders. The work and conversations taking place in the Platforms will be fed back to the global Coalition, to inform their collective, global strategy and inspire the international community. Mark Gough, Executive Director, Natural Capital Coalition commented, “We are delighted that Sustainability to Action will lead the UAE platform for the Natural Capital Coalition. Platforms like this one will serve to bring natural capital thinking into practice all around the world, and strengthen its relevance across different contexts. We have greatly enjoyed working with businesses in the region throughout the past year, and I am extremely happy to see this evolve and grow with the collaboration with Sustainability to Action." Sustainability to Action & the UAE Natural Capital Platform Our objective is to:

About Sustainability to Action Sustainability to Action (STA) is a group of consultants and associates based in Abu Dhabi and the UK who are experts in business responsibility in the areas of sustainability, corporate responsibility, materiality, stakeholder engagement, communications and behaviour change through social engagement. STA’s team work with stakeholders to embed and integrate responsible business practices in organisations by providing insight and consultancy services, training, coach-mentoring and thought leadership. For more information, please contact: Sustainability to Action Communications Office Mobile: +447525781327 Email: [email protected] Website: www.sustainabilitytoaction.com For further information on the Natural Capital Coalition visit: www.naturalcapitalcoalition.org Invitation to join the UAE Natural Capital Platform This network is aimed at decision makers within UAE businesses, government bodies, science & academia, NGOs and membership organisations It will consist of:

With a global climate change agreement that has been signed by 95% of the world’s governments, many companies are now thinking about how they can operate and continue to grow while cutting their environmental impacts in line with the new climate goals.

The United Arab Emirates has published its Intended Nationally Determined Contribution (INDC) (click here to see the full document) The UAE’s actions are based on a strategy of economic diversification that will yield mitigation and adaptation co-benefits. To achieve these commitments, the UAE is dedicated to pursue a portfolio of actions, including an increase of clean energy to 24% of the total energy mix by 2021. The UAE’s goals for national development are set in the Vision 2021, in alignment with the National Innovation Strategy, provides a roadmap for economic growth and social development rooted in sustainable initiatives and development supported by a knowledge-based competitive economy. It is clear that the focus of business must now shift from awareness and good intentions to active implementation to support the Government, whether that includes funding for new product innovation or supporting the roll out for projects and plans for sustainable development. Initiatives highlighted in the COP21 agreement, estimated to cost $16.5tn by 2030 by the International Energy Agency, may be a useful tool for companies by providing guidance for planning growth, assessing product portfolios, manage innovation development, redefine how companies measure their performance and review programs and processes needed to make the paradigm shift to a more sustainable future. UAE Energy and Water Efficiency The UAE has developed and continues to work on comprehensive policies to reduce energy and water consumption while promoting efficient use of resources through multiple channels, including:

Some of the key points that were raised throughout the COP21 from the private sector perspective included the following: The impact of global warming Naturally, when we consider any organisation, it will have a supply chain and that may well be directly impacted by climate change. This is an issue that needs to be addressed through scenario planning and an assessment of climate change impact on the suppliers' regions is required if business continues as usual or regulation intervenes. The cost of climate change Climate change impacts and mitigation highlight several potentail scenarios, including water scarcity, rise in temperatures and rise in sea level, all of which will have an economic impact. These financial costs will require new financing models to help address the challenges adequately. Awareness, knowledge and advance accounting for these costs will give companies a greater chance for success and allow for stability in an unpredictable future. Importance of employee awareness about how climate change links to their company Now, more than ever before, it is critical for employees to understand how their business has a direct impact on climate change and what role they can play to reduce impacts and drive positive change. For support with sustainability strategies, processes, reporting and communications, contact us at Sustainability to Action to support you in making the shift to a more sustainable future: [email protected] More information click here Looking after your people is essential in any successful organisation. That's the key function required from management. Employee development is one of the most important ways to drive productivity in the workplace. Well-trained employees will not only work efficiently but they armoire empowered and generally happier at work. Employee development should be designed to fit in with both your organisation’s needs and your employees’ preferences. By aligning training with both your business’ and your employees’ needs, you can successfully organise and implement an effective employee training program. Not only will you drive productivity in the department being trained but you will find your whole business inspired and motivated to motor ahead. Learning Methods There are essentially two learning methods that allow adults to become better equipped with dealing with their future work life; learning facts and process learning. To increase the performance of the company it is important to choose the training method that gives the desired results for the individual, while giving the best benefits for the company. Which methods and techniques to be used depend on the skills that employees need to develop. Fact based learning is appropriate when employees need to gain theoretical knowledge in a certain subject, for example increased factual knowledge of a task, increased industry expertise or a better knowledge about the company. When employees need to develop a more efficient work pattern or improve behaviour or performance, process learning is a better option. Formal and informal learning Learning can be divided in formal and informal learning. Formal learning usually means that external or internal trainers are hired to conduct a training course. The training can be carried out in house or outside the company where employees have the chance to meet people from other companies. Training can be conducted in groups via meetings, remotely via the web or a mix of the two. Informal learning means all learning that takes place during work projects, discussions, meetings etc. How to increase the performance of each employee Many employees have extensive experience in their area of work but their performance may not be as good as it could be. Alternatively, they perform well but they have the potential to perform even better. The longer a person works for a company, the more knowledge they get and the more they should be able to perform. Low or average performance may occur due to several reasons. To increase the performance of employees a short training course is usually sufficient. However, even though a course might have the immediate effect of increasing the knowledge, improvement in performance is a process that needs more time. The employee will need time to test the new knowledge that has been gained and thereafter performance can be improved. As a manager, you have a big responsibility to develop both you and your employees and create a successful team. Therefore, it is not always the best solution to send an employee on training for a few days and assume that will be sufficient in order to increase the employee performance. Often training is tremendously good and rewarding - while you are in the classroom. But what happens after the training? When you are back at work and as time goes by the new knowledge will fade and your high aspirations to change decreases when the workload is high. Here are some tips to help you get the best results from increased employee performance: Use experiential learning rather than theory. This type of learning is based on the employee's own experiences and on what the person feels she needs development in. When learning starts from the employee's own level, the employee will find her own opportunities for learning and development. Problem-oriented rather than subject-oriented learning. Think about which concrete problems need to be solved. Instead of just sending someone on a course, analyse the problem and the solution needed. This means developing the employee’s skills through learning based on problems at work, rather than following a pre-established pattern. Formulate a concrete development plan with the aim of improving performance. The employee is responsible for the development results, but the responsibility for driving the development process itself should be the manager. Blog written by: Erika Lindholm

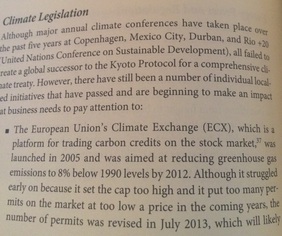

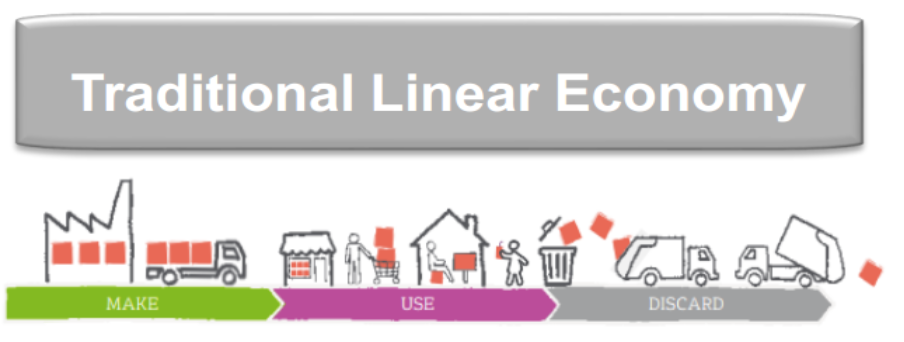

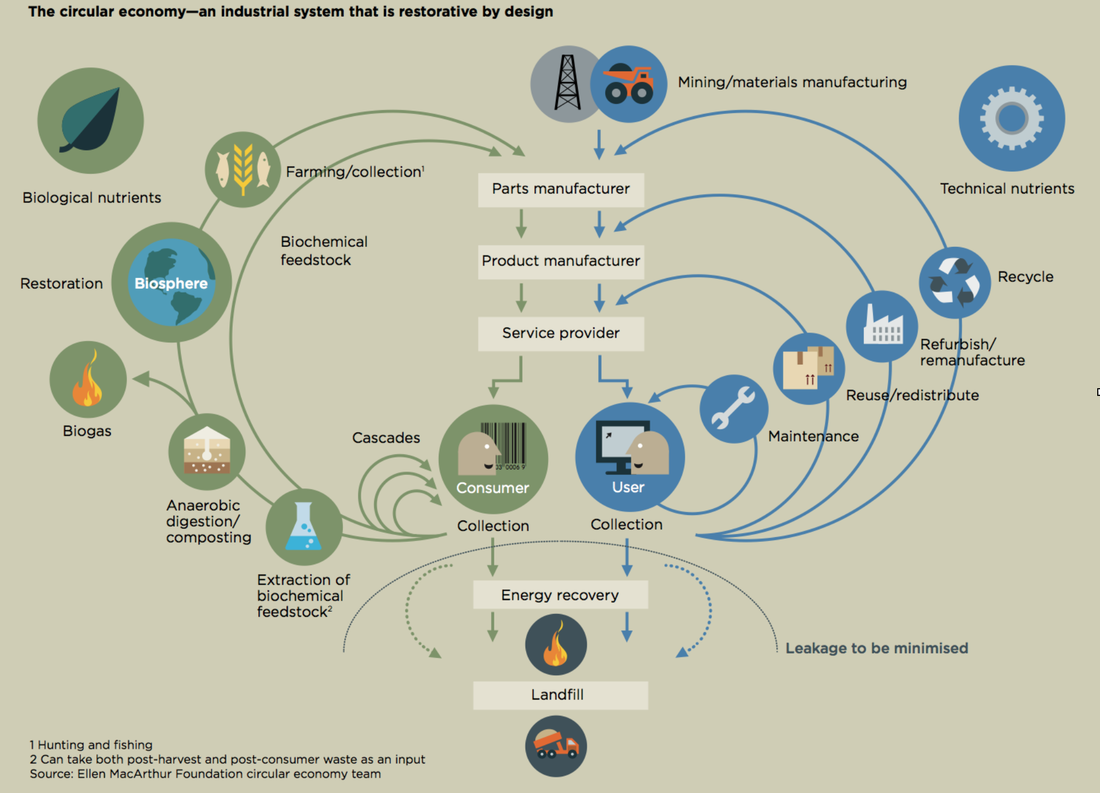

Blog written by Erika Lindholm, all artwork credited to the Ellen MacArthur Foundation In our current economic system, the linear economic system, we extract resources from our planet at an ever-increasing pace, and turn them into a product that we mostly dispose after use. From the perspective of an individual or organization, that seems efficient. However, zooming out to a global level shows how unsustainable this approach is. The circular economy is a redesign of this future, where industrial systems are restorative and regenerative by intention and design. A circular economy reflects the natural systems in which waste from one process becomes nourishment to another. Materials circulating in distinct streams - the biological, in which the materials are designed to be able to return to the biosphere without causing damage, and technical, in which the materials are designed to circulate while maintaining quality in order to become nourishment for industrial processes. The cleaner these flows and the higher the quality of the materials is when they circulate, the more value is retained in the economic system. Principles of circular economy Two distinct cycles: biological and technical. Starting from the idea that all materials will be included in a biological and technical cycle Ellen MacArthur Foundation developed a schematic overview of how the circular economy can function (picture below). On the left side of the figure: Clean biological material returns to the biosphere without doing harm, as biological nutrients that help to restore natural resources. This is done by composting or by anaerobic digestion for production of biogas and fertilizers. Production based biological material means new withdrawals from the biosphere. Materials become nutrition that becomes new materials, in an eternal cycle. Another possibility is to extend the life of the biological materials in a way that they are designed to be used in several different products following one another, before returning to the biosphere. For example, cotton clothing used as upholstery and then as insulation before the material is returned to the biosphere.

On the right side of the figure: Clean and defined technical materials (such as metals and polymers) are kept in circulation as nutrients for industrial processes in the techno sphere. In the outer circle (recycle) recycling of materials is done in ways that ensure materials do not lose in quality and can be returned to production, over and over again. Much of today's recovery is downcycling, a sort recycling where materials are not designed to be recycled, which means that they lose the quality of every recovery cycle. In the circular vision all technical materials are designed for upcycling, meaning that the materials circulating maintain their quality - and thereby their economic value, regardless of the number of cycles. A core principle to maintain the value of the materials and create economic opportunities in the circular economy is that the closer you can get to the innermost circles of the direct re-use, the greater the savings because the need for new raw material is reduced and less energy is needed for transport and processing of materials. The circle inside the recovery is about re-manufacturing, meaning that manufacturers take back the products to a remanufacturing facility to replace worn-out parts and refurbish parts that can be reused. The products are then reintroduced on the market with renewed warranty but at a lower price than newly manufactured counterparts. This is done today for example in the automotive industry with good profit margins. Innovative business models In the two innermost circles (reuse / redistribute and maintenance) the value-creating principle is that the longer the products and components can be circulated "as they are", the lower the cost of materials, labour and energy. These include re-distribution models (such as various types of second-hand markets) and innovative business models based on rental, subscription and sharing of products. The latter type of circular business models comes from the idea that access to a product in many cases is the most important factor, not necessarily to own it. Companies would then sell the product as a service, rather than the product itself. In this context, it is more relevant to speak of users rather than consumers. It is also important to design products so that they last long and is upgradable to work for several consecutive users (reuse) or, with the help of the maintenance / service can stay with a single user for a long time (maintenance). In these business models, the principle is that if the product can serve as many customers as possible and for as long as possible it provides more profit per unit. Design of circular economy A prerequisite for the breakdown in a biological and technical cycle to work is that products, components and materials are designed for circular economy, which is in a horizontal plane is about "designing out waste". Biological materials need to be as clean as not to cause injury when they return to the biosphere and technical materials need to be designed so that they can be recycled without loss of quality for each cycle. In addition, products need to be designed for disassembly. This means that the products must be easy to dismantle and composite materials should be avoided. Certain types of product should be modular and built with replaceable parts so that repair / update can easily be done instead of replacing the whole product. Products affected by rapid technological development should be designed for upgrading (preferably software-rate), not to prevent development. We would love to hear your thought and responses about the #CircularEconomy please comment and share with us! Sustainability communications is important because it enables dialogue and engagement between organisations and their stakeholders. Often, this communication can take different approaches, using multiple platforms with many organisations producing regular sustainability reports to share performance with stakeholders on material issues promoting transparency as a way to manage and operate their business.

In recent years, we have seen organisations and companies increasingly integrating sustainability into their value chains and reflecting triple bottom line accounting into their corporate governance. When companies are truly incorporating sustainability into their decision making top down and bottom up, then reporting on this scale should go beyond just transparency, and sustainability reports should provide those organisations with a wealth of data as a tool to help them in becoming more effective and efficient. Sustainability reporting comes into its own element here, adding real value and helping organisations, their stakeholders and communities to reap the true benefits of sharing sustainability performance data and information. One of the issues can be producing reports that fail to connect with a broad range of stakeholders and audience. Readers seek specific information in sustainability reports, depending on their needs. Sustainability reports should be designed in a way that allow flexibility and access to in depth details, avoiding generic, broad statements and information that doesn't provide the required level of disclosure and information. Sustainability reports already contain a wealth of information. However, many stakeholders don’t have the time to sift through all the information to find what matters to them which presents an opportunity to review how the reports are being used and what information is most important to users. Once you start planning your sustainability report, you can review the option that are available to you about how you present and provide the information in your sustainability report in a format and size that suits your stakeholders and readers, this can include: blog posts, info-graphics, informative tweets, presentation slides, mini-briefings, webinar presentations. These are some of the ideas that you can explore to present your sustainability achievements, challenges and progress, please contact the Sustainability to Action team for more ideas and to support you in getting your sustainability messages out. It's a new year ahead, 2015, with promise of new opportunities. So why not take this chance to make a better furuture as you make all your other plans. We share with you here some quick and easy steps that you can use and share with colleagues, friends and family. You can start with:

Good luck as you get involved and take the lead!  While science evolves, the overwhelming consensus among scientists is that climate change is manmade. The Copenhagen Climate Change Conference which took place in 2009 raised climate change policy to the highest political level with 115 world leaders in attendance. The question of a worldwide climate deal has been up in the air since talks fell apart at the 2009 UN conference in Copenhagen, and that was the last time that engagement at such a high level took place. Click here for details about this Conference. The latest reports from the Intergovernmental Panel Climate Change highlighted the acceleration of global warming and its effects. Despite strong involvement of the European Union and France in post-Kyoto negotiations, as well as agreed-upon concrete commitments, it is evident that government efforts alone will not singlehandedly prevent climate change. To achieve this, it is important to involve all stakeholders such as: national governments, businesses, financial institutions, scientists, civil society and private citizens. The next Climate Change Conference will be in Lima, Peru in December this year. Most view this upcoming COP as an opportunity to pave the way to signing a new treaty : Click here to access documents and the agenda for this upcoming COP. The most important sustainability question centres around how we can we sustain human life, economic prosperity and support developing countries without pushing dangerous levels of Green House Gas emissions. Many argue that this is indeed the greatest challenge for humanity in this century. What is needed is an agreement that will be effective and put the world on a pathway towards a decarbonised future, most likely to take place at the Climate Change Conference in Paris in 2015. It is encouraging to see that a number of events took place in recent months which indicate serious intention and political will, creating momentum behind action towards managing climate change. Those events include: 1- UN Climate Summit 2014 in September 2014 UN Secretary-General Ban Ki-moon invited world leaders, from government, finance, business, and civil society to Climate Summit 2014 this 23 September to galvanise and catalyse climate action. The original concept was to use this event as an opportunity to bring together the eaters of China and the US as well as the G8 leaders to commit to negotiations and invest in capital to ensure real momentum is gained as we head into paris later this year. The Summit brought together 130 governments who collectively made a concerted effort towards global action on climate change. 2- EU 2030 Package EU leaders agreed on 23 October 2014 the domestic 2030 greenhouse gas reduction target of at least 40% compared to 1990 together with the other main building blocks of the 2030 policy framework for climate and energy, as proposed by the European Commission in January 2014. This 2030 policy framework aims to make the European Union's economy and energy system more competitive, secure and sustainable and also sets a target of at least 27% for renewable energy and energy savings by 2030.agreement signed china and us to reduce emissions by 20% and china also agreed to peak and reduce emissions by 2030 3- World Summit of Regions for Climate Chaired by Arnold Schwarzenegger, former Governor of California and Founder of non-profit organisation, R20, this summit brought together regions and local governments from across five continents, as well as economic leaders, in order to formulate a new international agreement on climate change. The summit ended with concrete commitments for sustainable development, by signing the Paris Declaration – a real road map for the United Nations conference on climate change (COP21) that will take place in Paris in 2015. The Summit closed with a signing ceremony involving six networks of cities and regions who commit to the Paris Declaration. These are all positive indicators towards a tangible global agreement on climate change, the challenge is to ensure that concrete outcomes emerge. |

Categories

All

AuthorSandra Anani is passionate about sustainability, with over 19 years’ experience. She has dedicated her career to sustainable development and communications. Archives

November 2022

|

RSS Feed

RSS Feed